Customs declarations

A customs form is required if you send parcels to anywhere outside of Jersey.

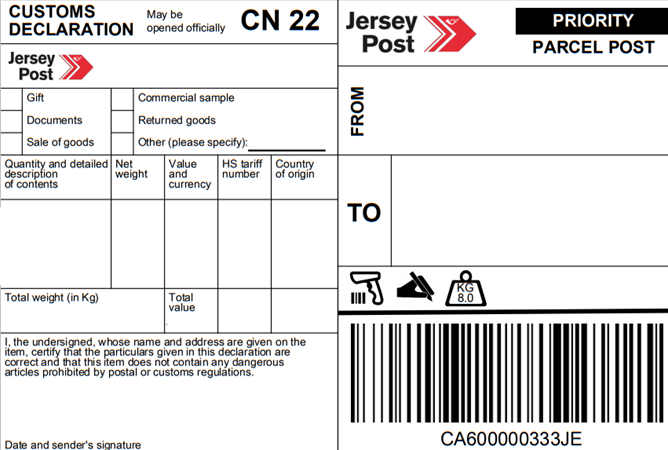

There are two types of forms, depending on the value of the items sent. Items with a value up to £270 require a CN22 declaration form, and items over £270 require a CN23 customs declaration form.

Since 1 January 2021, it has been mandatory to provide this information electronically so that this can be passed on to customs authorities in advance of the item arriving in the destination country.

An example of a CN22 customs form

For items sold

Completing a customs declaration for commercial items you're sending

The declaration must include a description of the contents and its value. It must also show its commercial items, and 'Sale of Goods' field must be selected as the item category. You should also include:

- The HS code and country of origin

Enter the HS code and country of origin fields on the form. If you are sending more than one item, list these details in the same order as the items in the ‘quantity’ and ‘detailed description of contents’ fields. The country of origin is where the goods were produced, manufactured, or assembled.

Get help classifying your goods.

- Sender’s name and address

To allow the destination country to process the parcel, please make sure the declaration is completed accurately and in full, including the Senders telephone number. Leaving details off customs declarations can lead to delays, your item being returned to sender or even seized by customs.

You can get more information from the HM Revenue & Customs (HMRC) website.

- Recipient’s name and contact details

To allow a smooth transition through customs, please include the recipient’s mobile number. This enables the customs authority to contact the recipient easily in case of any queries regarding the item for delivery.

You can get more information from the HM Revenue & Customs (HMRC) website.

Declaring third-country exports

If you are shipping goods directly to a Third Country, which includes the EU from 1 January 2021, an Export Declaration will be required.

Indirect exports going through the UK will require a HS Code to be presented to the Carrier / Shipping Agent before the goods are shipped.

You can get more information from the gov.je website.

Transit documentation

If you are exporting freight from Jersey to or across Europe, a transit document may be required. Contact Jersey Customs and Immigration directly on 01534 448088 to receive an application form.

Export licenses

Some goods can only be exported under the authority of an export licence. These include but aren’t limited to military goods, animal products, medicines, antiques and works of art.

For more information, you should contact Jersey Customs and Immigration directly on 01534 448088.

Buy Postage Online

The simplest and most convenient way to ensure you meet all the customs requirements when sending items off-island is to use Jersey Post’s online postage portal.